CardsFTW #104: Teen Card Deep Dive

Plus, the return of the true airplane rewards card

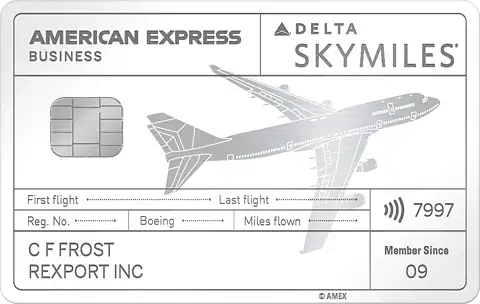

Delta’s Metal Airplane Card Return

A couple of years ago, American Express and Delta created a unique physical card for their Delta SkyMiles Reserve card that was made out of an actual airplane. The card metal was cut from retired aircraft and then personalized with cardholder data (and the requisite payment technologies).

Last week, Delta announced the return of airplane metal cards. I’ve never wanted a Delta card as much as I do now! (I don’t frequently fly Delta from my home base in Los Angeles). There is a limited number of cards available only through June 5, 2024. I don’t need the miles, but I do need this card for my collection. I love this as a clever marketing approach and something beyond just a metal card: utilizing a unique metal. It speaks to how consumers value the relationships with their cards and brands.

Everything You Need to Know About Teen Debit and Credit Cards

Note: I am so excited to share a deep dive written by one of the newest members of the Totavi team, Julia Nicholls. As our resident Gen Z member, I asked Julia to dig into cards for younger consumers with a better perspective than I have. Julia is an Associate Consultant at Totavi and started her career in cards, working with me as a product management intern at Vertical Finance on the Grand Reserve World Mastercard.

In the Beginning…

I received my first debit card when I was in middle school. I remember being so excited to swipe my card at a terminal that I made my friend take a video of me when I did it for the first time (chips were introduced about a month later, so the joy was short-lived). Despite being on the older end of Gen Z (and therefore having technology in my life from an early age), one thing I did the old-fashioned way was handle money: I kept all of my cash in an envelope in my dresser, which made it very difficult to keep track of savings.

When I turned 18 and was about to leave for college, I received my first-ever credit card: the Bank of America TravelRewards card. This was when I first learned about credit, albeit not in very much detail. I knew that I would pay for things on borrowed money, and I had to pay it off every month; otherwise, I would go into credit card debt (which my high school economics teacher did a fantastic job of teaching us about). Once I had my card, I only used it for things my parents normally would pay for (like groceries, prescriptions, etc.), and at the end of the month, I would send the amount to my dad, and he would transfer my money, and I would pay it off. It wasn’t until I was 19 and working for Matthew for the first time that I really started to get an understanding of the credit card world.

Debit Cards vs. Credit-Building Cards for Teens

Credit-building cards have traditionally been used by people over the age of 18 to establish a credit history or repair a poor history. Recently, however, these cards have been made available to teens under 18 to allow them to establish a credit history before they are old enough to get their first credit card. A few companies, such as Step, cater to this use case.

Whether the cards are credit-building or debit cards, each provides value for the kids who end up using them. Teaching teens important lessons like financial responsibility, budgeting, setting savings goals, and eventually paying off their credit cards creates great habits before the very real threat of credit card debt is even introduced. If “you’ll learn so much!” isn’t getting your resident teenager excited about using their card, most of the companies we profile below offer real money rewards for playing their financial literacy games or hitting savings goals–and who doesn’t like free money?

Benefits

I think that most people, at least when they first get their cards, feel like the money they are spending isn’t real. Whether it’s because you aren’t spending physical cash and seeing the amount go down in your wallet or because you just got a credit card and you have access to money you don’t even have to begin with. I think struggling with the “monopoly money effect” is something that most people experience at least once in their life. Having your kids' relationship with money be digital-based rather than cash-based, paired with financial literacy courses, will prepare them for when they are financially independent.

Benefits for Teens

- Studies show that children and teens who engage in financial literacy courses grow up to have better financial situations and accumulate less debt.

- Teenagers can practice not spending money as soon as it is available to them (something I still struggle with personally) and have the responsibility to set up savings goals and put money aside for those goals.

- Teens have the independence to spend money how they want, preparing them for when they are financially independent and do not have their parents to warn them against poor spending habits and decisions.

Benefits for Parents

- While teenagers do have independence in how they spend their money, parents still have insights into how their children are spending or saving their money and could have the option to set up transaction notifications to receive an alert every time money is spent.

- Selecting an account with more parental controls means parents can rest assured knowing that their teen is not spending too much money or spending money where they shouldn’t be.

- Connecting your bank account to your child’s account means you can always get them money in case of emergencies (or for whatever reason); no more trips to the ATM!

- Opening a bank account with your teen means you can start money conversations early and positively and encourage learning through financial literacy courses.

- Easily set up allowances or chores rather than needing to use cash.

Your Options

Parents have many options, with different card features, account types, and fees. We're taking a deeper look at what Step, Jassby, Till, Greenlight, and Captial One offer and comparing the tradeoffs between them.

This post is for paying subscribers only