CardsFTW #85: Black Friday's Decline in Closed-Loop Cards

Plus, Virtual Cards and My Mighty Oaks Card

A Decline in Closed-Loop Cards

The Wall Street Journal published an interesting story on Tuesday about the decline in the use of retail cards, also known as closed-loop cards. What exactly is a closed-loop card? It’s a card that can only be used at a specific retailer (e.g., your Target REDCard can only be used at Target). In contrast, an open-loop card features a network logo like Visa, Mastercard, Discover, or American Express and can be used across various merchants. These networks are also known as open merchant networks. As a side note, sometimes people refer to the network logo as a “bug,” but why is that?

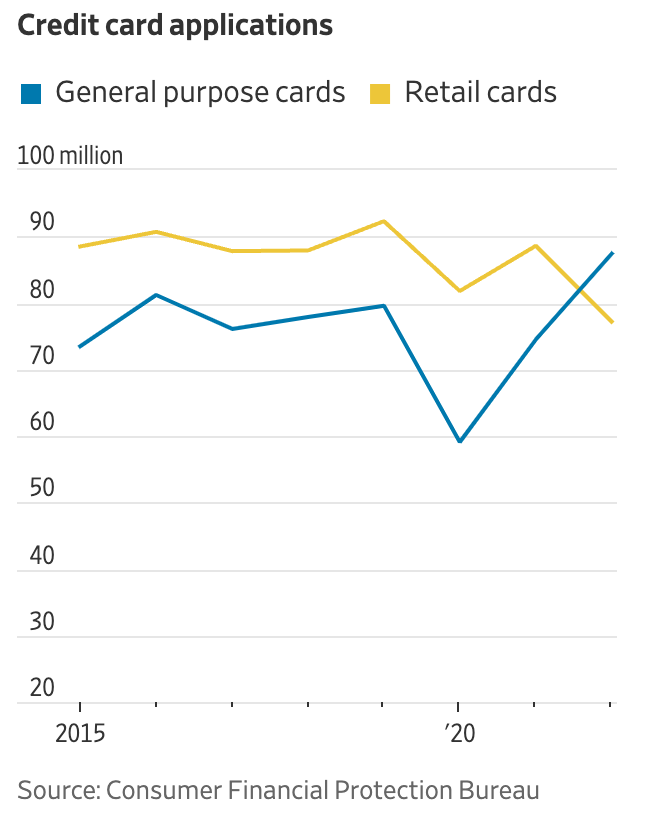

The WSJ’s article references Consumer Financial Protection Bureau data, highlighting a significant drop in retail card applications in 2022 compared to 2021 – a decrease of about 11 million, or 12.5%, and a 37% decline since 2015. Meanwhile, open-loop or general-purpose cards have seen a 33% increase.

These struggling cards, called closed-loop cards, store-branded cards, and private label cards, don’t typically stack up against open-loop cards. They often carry substantially higher interest rates (28.93% vs. 21.19% according to Bankrate), limited usability, lower credit limits, and the rewards are usually somewhat … meh.

Traditionally, these cards have been a method of financing, sold at the point of sale. I remember applying for my first closed-loop card at Macy’s to save 10% on a couch purchase, which was issued by GE Money (now Synchrony). I’m not sure I ever used the card again. These cards usually offer some loyalty benefits and promotional financing deals.

However, the value of store cards has diminished with the rise of buy-now/pay-later (BNPL) options, also known as point-of-sale financing. If you want to finance a single transaction, BNPL provides an understandable financing option (although many are not legally loans in the definition under regulations). Unfortunately for retailers, while private label cards generate significant loyalty and income over time, BNPL providers charge merchants a fee (often higher than the interchange fee). They are attempting to build networks of their own moving spend across retailers.

There are some bright spots: Target’s REDCard program, both in debit and credit, is well-loved by many users. Amazon has both an open-loop Visa from Chase and a closed-loop card from Synchrony that appear to perform well.

Open-loop cards are generally better for consumers, offering more flexibility and revenue opportunities for retailers, who can benefit from spending at other locations and gain additional data.

Some folks are betting on closed-loop cards. Tandym is building a private label, REDCard-like experience for online retailers, paid via ACH debit transfers. Indeed, Tandym uses the marketing line “Tandym is your digital store card wallet.”

I don’t believe retail cards will disappear entirely. I personally love my Target REDCard. However, in the long run, open network solutions always win.

Mighty Heavy

An update from last week: I received my Acorns Mighty Oak card featuring the Rock. It is made out of Tungsten, not rock, and is quite heavy (20g!), making it one of the heavier metal cards. My signature looks tiny and terrible.

Square invented this signing-on-card thing, and their design seems better executed:

Acorns folks need to work on card design – such a blatant copy. Didn’t they get the memo that we’ve switched to white cards being cooler again?

Privacy Cards

The Wall Street Journal recently published an article on virtual credit cards and how to use them. While the concept isn’t new (we believe it’s been around since the early 2000s), what’s changed is how mainstream they’re becoming. The fact that the WSJ is writing about it proves this point. If you’ve logged into your credit card account lately, you might have noticed that banks are now pushing these cards more than ever, making them a go-to tool for safer online shopping.

Virtual cards work like a digital mask for your card details, offering a one-time-use number for online buys. This allows you to create a virtual card for each transaction, giving you more control and peace of mind. It’s like having a unique password for each site you shop at. However, for those starting a card program, be aware that virtual cards come with some complexity, especially when handling online orders that may ship in multiple parts, requiring a hold to be released and another authorization.

In CardsFTW #2 (yes, our SECOND post–it seems like just yesterday), we discussed Privacy.com and the difficulties in balancing being both a consumer provider and an infrastructure provider. While this is still true, banking and technology have come a long way in the last several years. In 2019, there was only one Credit-Cards-as-a-Service provider, but now there are over half a dozen. The same can be said for virtual cards. During the 2010s, we saw a boom in card programs that provided one-time-use cards like Privacy.com and Final Card. Green Dot offered WebSecret, a virtual card number non-reloadable prepaid card, in the early 2000s. New entrants like Cloaked take this one step further with virtual cards, private phone numbers, and more.

Big banks like Discover and MBNA/Bank of America offered virtual card numbers on demand in the early 2000s, and Capital One and American Express have dipped their toes in the water. Apple Card features on-demand virtual card numbers and the ability to rotate the CVV (security code). (The Apple Card is built with the original Final Card feature set.) Ultimately, this feels more like a feature than an entire product.

Thank you for reading CardsFTW. This post is public, so feel free to share it.

CardsFTW

CardsFTW is a weekly newsletter, released most Wednesdays, that offers insights and analysis on new products in the credit and debit card industry for consumers and providers. CardsFTW is authored and published by Matthew Goldman and Ellen Perl of Totavi, LLC. Totavi is a boutique consulting firm specializing in fintech. We bring real operational experience that varies from the earliest days of a startup to high-growth phases and public company leadership. Visit www.totavi.com to learn more.

*Indicates a company where Totavi, LLC has a business relationship.