CardsFTW #90: What Did They Do To My Amazon Fresh Store?

Plus, Fraud, Junk Fees, and Climate Cards

What Did They Do To My Amazon Fresh Store?

Six months ago, I wrote a post for African payments startup Stitch Money about the future of contactless payments. In that post, I wrote about the magical experience of shopping for groceries at my local Amazon Fresh store. The process was so simple: walk in, scan your palm, put things in your cart or bag, scan your palm, and walk out.

I don't live super close to the Amazon Fresh store in Pasadena, so I don't go frequently. However, I was on that side of town and needed a couple of things, so I figured I would pop in. There was a "grand reopening" sign that I thought was more marketing than anything else.

Unfortunately, they had changed the store. Gone was the original open entrance, replaced by a classic supermarket vestibule. There was no scanning in at the entrance, which seemed odd, but I figured I would sort it out. I grabbed a few items, including alcohol, which previously had a special in-store check-out. Now, you could pick it off the shelf, but you would have to go to a check-out line, as self-checkout alcohol is prohibited.

The next thing I knew, I was in a 100% normal grocery store situation. There were lines. There were confused cashiers. Yes, I could still scan my palm to pay, but I can do that at Whole Foods, too. It wasn't faster or better. With some investigation, I learned that the way to recapture the old magic is to use a cart (I had just picked up a few things without one). The cart has cameras and scanners on it so that when you leave, the system knows what's in your cart.

The cart idea seems better than traditional shopping, but the experience overall is worse than when it started. Why would Amazon go backward?

I have a theory: grab whatever you want shopping is innovation for which the market isn't ready.

On previous occasions, not only was my shopping experience super fast and magical, but the store was also quite empty. I assume the speed factor was part of this (if you can shop quickly, the store can turn over customers more quickly). However, I am now guessing that the store was simply...empty. Amazon can't subsidize a 42,000-square-foot supermarket. It needs people.

In contrast, when I went most recently, with the degraded shopping experience, the store was a lot busier. Was it just too weird earlier?

Payments industry experts like to talk a lot about the history of money. Since the early commerce of barter, through coins, checks, and on to contactless payments, how to buy things has certainly evolved. However, the old ways never truly go away. We all barter (I'll buy you a coffee for a few minutes of your time), and we still have to use coins, bills, and checks (I had to use one this week!).

Payments are ubiquitous, but the methods should fade into the background for most people (not me!). I think the Amazon experience may have been too much, too soon, in suburban Pasadena. I hope it returns, but I'll probably just get my groceries delivered now.

Walmart's Everyday Fraud

If you haven't read Pro Publica's report "How Walmart’s Financial Services Became a Fraud Magnet," please do so now (or as soon as you finish reading CardsFTW and sharing it with at least 10 colleagues!).

For many of us who work in financial services, there is nothing surprising in this article. Unfortunately, scammers are very good at getting people to do very dumb things that allow them to steal, cheat, and launder money.

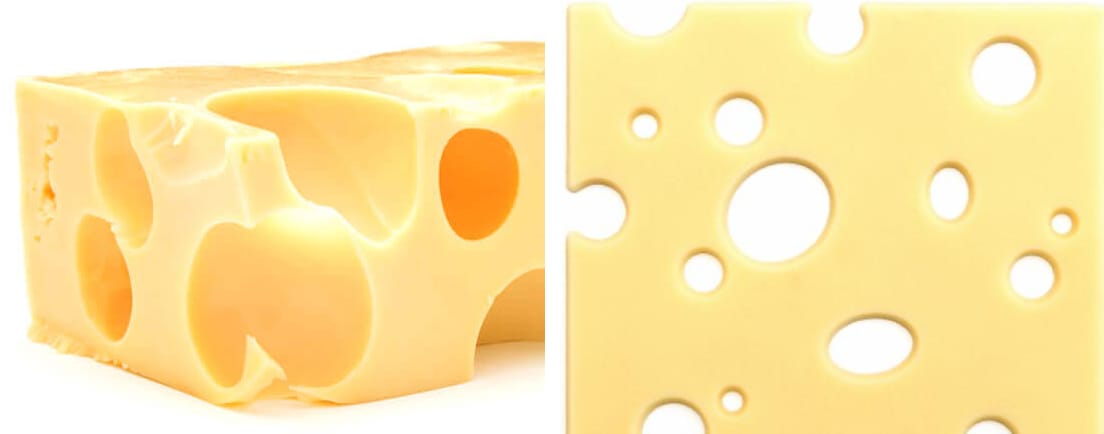

I won't recap the story here; I encourage you to read it yourself. I want to highlight how individual steps or holes create very large holes. I've been thinking a lot about this, which can described as a catastrophic failure cascade, or, more colloquially, when the holes in the Swiss cheese line up.

Buying a gift card by itself isn't a huge problem, although people could still be scammed. Allowing customers to buy many gift cards in a single transaction or day is a problem. Allowing those cards to be used to buy other gift cards is a problem. Making everything real-time is both convenient and also a problem. (You know how as soon as you hit send on an email, you realize what's wrong? Same thing here, imagine how much fraud a 60 minute hold on gift cards can stop.)

Walmart has the power to limit fraud. It just isn't taking those actions.

What Happened to Aspiration?

Aspiration was once a high-flying neobank with a climate-friendly approach. They were going to SPAC. They were going to talk to me about being Chief Product Officer (several times, bullet dodged). Now, the company is in the news for a Federal probe related to sponsorship of the LA Clippers' new arena. Instead of Aspiration patches on their jerseys, the Clippers will sport PayPal Shopping / Honey patches and play in the under-construction Intuit Arena (next to SoFi Stadium–fintech is taking over).

I also heard that Aspiration has rebranded to Catona Climate. The new LinkedIn page for Catona links to Aspiration's website. What a strange turn of events.

Overdraft Fees

Finally, this week, the CFPB announced efforts to limit overdraft fees.

Overdraft fees are bad. Strangely, the CFPB is only planning to regulate big banks overdraft fees. Why? Because small banks could really suffer as they are really dependent on these fees. Do you know those friendly local credit unions? They are also loving their fee income. A recent Marketplace report covered institutions like San Diego County Credit Union, which are highly dependent on these fees.

I'm all for more reasonable overdraft fees. They are punitive and affect low-income users the most. One of our top selling points at Green Dot 15 years ago was simply: "no overdraft fees." Could you overdraft? Not easily. Is this better than getting hit with a $35 fee? Yes.

I don't think the CFPB should only make big banks change here. If we declare something really bad for consumers, it should be bad for them, no matter where they bank.

CardsFTW

CardsFTW is a weekly newsletter, released most Wednesdays, that offers insights and analysis on new products in the credit and debit card industry for both consumers and providers. CardsFTW is authored and published by Matthew Goldman and Ellen Perl of Totavi, LLC. Totavi is a boutique consulting firm specializing in fintech. We bring real operational experience that varies from the earliest days of a startup to high-growth phases and public company leadership. Visit www.totavi.com to learn more.

*Indicates a company where Totavi, LLC has a business relationship.