CardsFTW #96: BaaS is a Four-Letter Word

Plus, Credit Card Marketing is Tainted and Chime's New Card-Linked Offers

It's no secret that the companies we have traditionally called banking-as-a-service providers (BaaS) have been under pressure over the past 18-24 months, compared to experiencing a huge boom in the years prior. Many companies in this broader space have been acquired, gone out of business, or been embroiled in legal battles (see Rize, Apto, Solid, Synapse, etc.). The past four weeks have felt like a shift in the tide to me, though, and now many companies are actively distancing themselves from the term.

I always thought BaaS was a funny term. It's derivative of "software-as-a-service," which was an interesting name because most software used to be a packaged good (literally, like in a CD), and you bought it once with effectively a perpetual license to use it. With the shift to cloud-based computing, companies started to sell software as a subscription. With subscription-based pricing, your software was now delivered as a service: updates are included, plus hosting, etc. Generally speaking, I think it was a good thing for consumers and businesses. For SaaS providers, it was amazing as investors got very excited about the predictable recurring revenue streams SaaS providers compared to the lumpier sales of packaged goods.

Banking, however, has always been delivered as a service. You pay a monthly account fee, an annual membership fee, or transaction fees because you are not, in fact, buying a copy of the bank to use, like with software.

Yet, venture capital-backed industries love nothing more than a trend. Adding "aas" to just about everything started to become very cool, driving valuation, etc. So, someone coined the term banking-as-a-service to refer to companies that provide software in the financial services industry. Along the same lines, people started using the popular phrase "annual recurring revenue" to refer to revenue that was not recurring. It just sounded good. It helped to put Patagonia vests on people.

I spent the first part of the BaaS hype saying things like "Aren't they just program management platforms?" or "Isn't that a core processor?" and feeling like a curmudgeonly old man. Well, I may be a curmudgeon, but I'm not that old; I'm just old in fintech terms.

The fall of the fortunes of the BaaS ecosystem has many causes: payment fraud, cryptocurrency valuation swings, outright deception and founder fraud, regulatory actions, AML/BSA violations, and more. However, the pitch has reached new heights this week.

In addition to many private conversations, I read many articles on the topic:

- "This Virginia bank wants to rewrite the rules for banking as a service," American Banker, February 22, 2024

- "Treasury Prime has laid off half its staff Banking Dive, February 28, 2024 (NB: Jason Mikula broke this news)

- "Leaked Treasury Prime Docs Show Risks Of BaaS Business: Churn, Concentration, Slowing Growth" Mr. Mikula's Fintech Business Weekly, March 2, 2024 (which also highlighted provider Unit's sponsor partner Piermont stepping away)

- "Breaking: Lineage Hit With FDIC Consent Order Fintech Business Weekly, February 23, 2024 (which highlighted that both Synapse and Synctera had partnerships with Lineage)

- "Green Dot faces Fed's proposed consent order Banking Dive, February 28, 2024

- "Metropolitan Commercial to exit the BaaS business entirely American Banker, March 1, 2024

Taken together, it looks a bit like the sky is falling. In addition to public statements, I've been speaking with leaders at various companies in the industry about this topic, and it is clear:

Most companies no longer want to be associated with the term BaaS.

It's not true for everyone. Treasury Prime CEO Chris Dean still refers to his company this way; others acknowledge that it's how the market looks at them. However, there is a shift to avoiding the term and instead using something more concrete, such as "debit card program manager" or "card processing platform."

There have long been many variations among BaaS companies. One might only do debit issuing, one might primarily do ACH money movement, and another might only do credit card issuing. These are all flavors of using modern, developer-focused platforms to deliver core banking infrastructure. Some traditional providers (e.g., FIS, Fiserv) may argue they've been doing this all along!

I think part of the move away from the term is about reducing the use of a term associated with several negative press events and regulatory pressure. Part of it is just that the BaaS rocketship ride might be over (or over-ish; Synctera, a company that helps other companies issue card products, just announced an $18M Series A extension Monday). Part of it is the pendulum swing away from "banking middlemen."

Look, middle people make the world go round. There is nothing wrong with being middleware. Non-banks seeking banking services have almost always interacted with third-party technology platforms. Most banks do not own their technology stack. Neither the bank nor its regulators want that. It's better to use an external platform for reasons of investment capabilities, security, etc. However, the past few years have seen a middle layer of go-to-market come as fintech companies developed new operating models that placed more distance between the program and the bank.

In the coming years, there will be many more programs with direct contracts with banks, even though they will still process or have program management support from a third-party non-bank. We've been building products like this for decades. Some of this isn't really that new! We'll probably call these products co-branded debit cards, much like co-branded credit cards. When I joined Green Dot in 2006, we offered co-branded debit cards for NASCAR, Boost Mobile, and Cingular (wow, those deals didn't age well).

I'm going to try to use the phrase "BaaS" a lot less because it doesn't mean a lot, and it just begs for too many dad jokes (pain in the baas, etc.) I'm excited to go back to being clearer about what products companies provide and describing multi-product companies as fintech software platforms. That's good enough and probably more accurate.

We are still going through a post-bubble reset of valuations, staffing, revenue models, and operating agreements. That doesn't mean financial services will go away, nor that the many unique and innovative banking products developed over the past few years won't live on. They will, and new ones will come to market. Some banks will leave the sponsor bank business, and others will join. The world turns, and products will still be delivered...as a service.

CFPB Targets Credit Card Marketplaces

Following months of rumblings about the CFPB going after credit card marketplaces like Credit Karma, NerdWallet, and Red Ventures properties such as Bankrate and The Points Guy, the agency accounted a protection circular aimed at "Preferencing and steering practices by digital intermediaries for consumer financial products or services."

The CFPB circular clarifies that "operators of digital comparison-shopping tools can violate the prohibition on abusive acts or practices if they distort the shopping experience by steering consumers to certain products or services based on remuneration to the operator."

Prohibiting compensation from driving placement in these sites strikes at their very heart. For the most part, these sites do not have strict editorial walls (I know many claim to, but some certainly do). Placement on a page is dictated by a formula involving expected click rate, expected approval rate, approval payment, and service effective revenue per click. Comparison sites are businesses that try to optimize their monetization.

While I was at Bankrate, we dictated placement and ranking on the credit card pages on creditcards.com and bankrate.com through a monthly auction (much like Google Ads, but way more slowly).

It is not a secret that credit card issuers compensate online marketplaces for their referrals. Still, these new rulings could put a damper on monetization to level the playing field for both consumers (who may not be aware of the effects of paid commissions) and between issuers, allowing smaller or newer entrants to gain market share more easily. As it stands today, it is tough for a new card issuer to get any traction online due to the high payments from large issuers.

The editorial lines have long been a bit thin. While I was at Bankrate, the team for TPG refused to take free travel from airlines they were reviewing, but we frequently reviewed credit cards for which we were being paid. TPG may be a special case; if you're looking for a wild story, you can read this report from accountable.us.

Expectations are that the CFPB may launch a public card comparison site in the coming years, as they have much of the required data. I'm not sure it's the government's place to do this, but the prospect of a non-monetized comparison is compelling. We would find some reviews that don't end with, "but you should probably just get a Chase Sapphire instead."

CFPB Late Fee Rule

Late breaking news this week is the CFPB has issued a final ruling limiting credit card late fees. Large card issuers (with more than 1 million accounts) will be limited to $8 late fees, as anticipated last year. More to come next week!

Chime's Card-Linked Offers

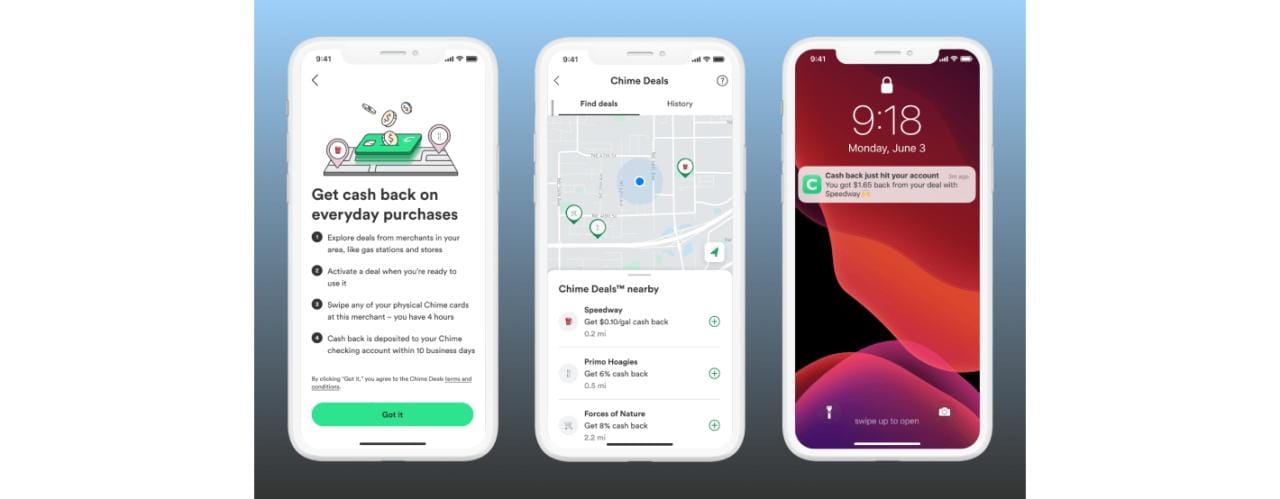

Finally, this week, Chime announced its new "Chime Deals," which are card-linked offers powered by Upside. Merchant-funded card-linked offers are not new but are experiencing a resurgence as fintech issuers look for creative ways to juice rewards and cashback while adding to their bottom line.

Like other card-linked offer networks such as those from Cardlytics/Dosh, Kard, and Triple, merchants offer a cashback offer to the issuer for cardholders who activate and spend at their store (typically with some spend minimums and maximums). In addition to the reward earned by the cardholder, the network (e.g., Upside) and the program (e.g., Chime) both earn some revenue here, too.

These offers are nice; I've saved thousands in my life with them, but as more and more cards have them, they become less of a differentiator for any one program. In addition, they can feel like a lot of noise to users because there are so many.

Still, this is a nice addition from Chime and will benefit their cardholders!

CardsFTW

CardsFTW is a weekly newsletter, released most Wednesdays, that offers insights and analysis on new products in the credit and debit card industry for consumers and providers. CardsFTW is authored and published by Matthew Goldman and Ellen Perl of Totavi, LLC. Totavi is a boutique consulting firm specializing in fintech. We bring real operational experience that varies from the earliest days of a startup to high-growth phases and public company leadership. Visit www.totavi.com to learn more.