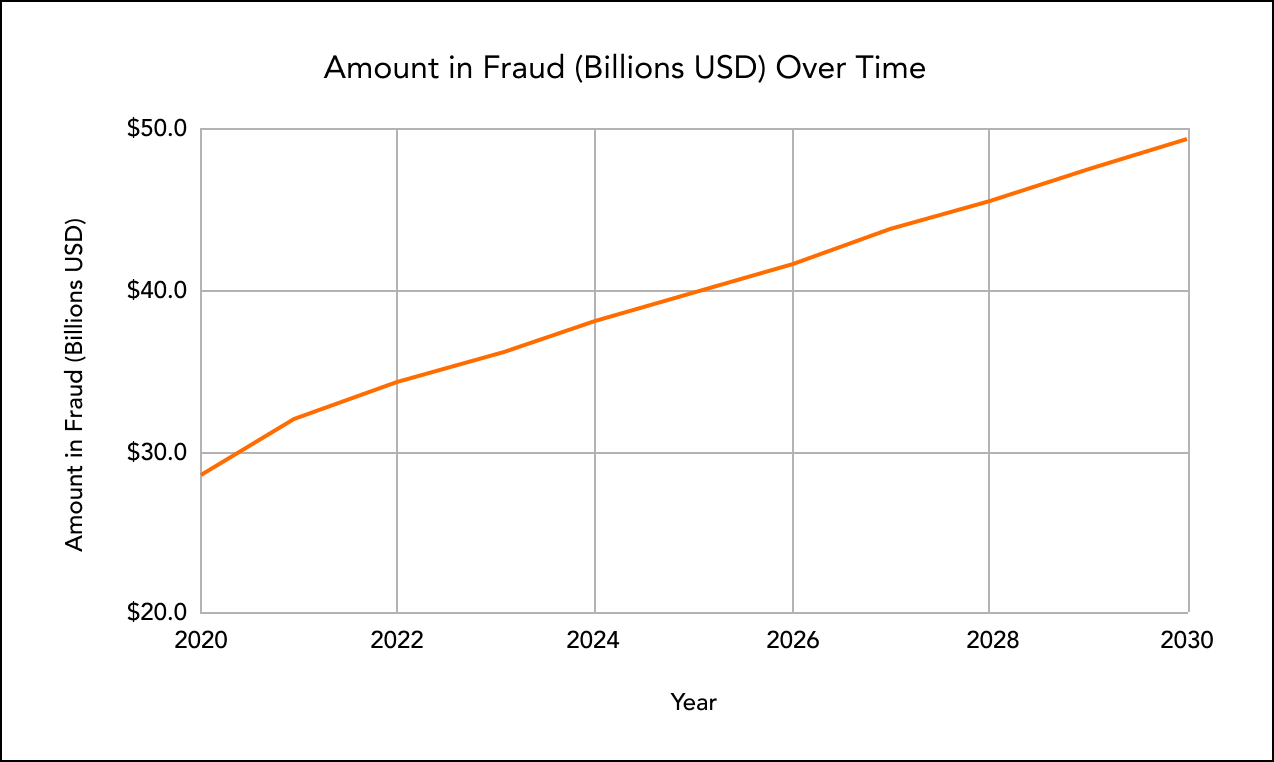

CardsFTW #102: Spending is Up. So is Fraud.

With increased consumer spending, players across the payments value chain have also experienced increased fraudulent charges, chargebacks, and disputes.

I recently discussed the shifting dynamic of the card market, driven by macroeconomic factors – mainly rising interest rates. With higher interest rates, I would typically expect Americans to cut back on spending. If you recall from Econ 101, the Federal Reserve generally raises interest rates to reign in inflation, which only happens if people cut back on spending.

However, as of Q4 2023, Americans had accumulated $1.13 trillion in credit card debt, with no sign of slowing down. With increased consumer spending, players across the payments value chain have also experienced increased fraudulent charges, chargebacks, and disputes.

Chargebacks911 reported that Americans disputed $65.2 billion worth of charges in 2023, an average of 5.7 chargebacks per cardholder, each valued at around $76. Industry experts project this figure will increase over the next few years.

I’m also hearing anecdotal stories from friends who have been longtime customers of Amex Platinum and Chase Sapphire Reserve, who have noticed that receiving reimbursements for insurance claims or disputes is increasingly difficult. Higher hurdles for successful claims suggest that credit card companies are under increased pressure.

Bad Data is Exacerbating the Situation

Bad transaction data contributes to losses in three significant ways:

- It diminishes our ability to create robust rules and logic to prevent fraud

- It causes cardholder confusion and leads to false chargebacks

- It prevents card issuers from accurately authorizing transactions

With increased financial pressure on consumers, cardholders are also more likely to scrutinize their monthly bills. Since data quality is poor and sometimes unreadable, consumers are likelier to report “unrecognized charges,” otherwise known as “friendly fraud.”

According to Clearly Payments, 34% of chargebacks were filed because the cardholder did not recognize the charge and believed it fraudulent. ECS Payments reports that “Unrecognized Charge” is one of the top 6 reasons for chargebacks by cardholders.

Unfortunately, banks and neobanks on the card-issuing side of the house are working with the same data, which leaves cardholders confused about the transactions reflected on their statements. However, card issuers must use that same low-quality data to authorize transactions in mere seconds.

Transaction data enhancement has been a challenge that has stymied the industry for decades. Local data is always difficult. In my brief foray outside fintech, I spent three years at YP.com, a major local data provider, and saw the mess of data going into the system. A great example comes from my early days of transaction data at Wallaby Financial. We would make test transactions at a great local coffee shop across the street from our first office. The ISO who set up the shop’s merchant account misspelled the name and location, leading to confusion and failing to match to understand it was a coffee shop. Instead of “Amara Cafe Pasadena,” it was “Alra Cafe Pasdadena.”

Sponsored by Spade

Spade is real-time merchant intelligence for the card ecosystem

Garbage In. Garbage Out.

For new card startups, there are many tools to help minimize fraud and dispute costs. Some companies help you manage the actual processing of disputes and chargebacks. FIS Global and Accertify offer services and chargeback management tools that can be used standalone or in addition to your in-house tools.

Earlier in the process, you’ll want to create rules (or rely on those created by others) to minimize the volume of disputes and chargebacks. Providers such as Kount and ACI Worldwide aim to reduce the probability of chargebacks in real time while maximizing legitimate revenue opportunities for merchants.

Because all players along the payments value chain lose money when cardholders file disputes and chargebacks, they all create their own fraud detection rules.

Here’s an example of how a $100 chargeback impacts players along the payments value chain.

Large issuers strive to give their customers transparency. However, depending on the data received by issuers such as Chase, a cardholder might see a transaction that has as few details as:

- Merchant name

- Transaction amount

- Date of transaction

Or, a cardholder might see as many details as:

- Merchant name

- Transaction amount

- Date of transaction

- Address of merchant

- Phone number of merchant

- Google map image of the merchant’s location

- Merchant type

- Method of payment (e.g. in-person, Apple Pay)

Newer card issuing platforms such as Highnote also strive to give their customers more control over which transactions are approved or declined in real time. “Collaborative authorization” allows card companies to augment their business logic with the fraud prevention logic already baked into the networks to make better decisions on which transactions are legitimate.

Without high-quality transaction data, applying these tools can feel like applying multiple Band-Aids to a gaping wound that requires hospital-grade gauze. As the popular adage goes – “Garbage in, garbage out.”

Spade - Transforming Garbage into Gold in Under 50ms.

Spade is a relatively new entrant in the payments space that has gained a lot of attention for securing high-profile customers such as Mercury, Sardine, Coast, and Unit in a short amount of time. Their solution to fraud mitigation focuses less on creating more rules but on the underlying reason that rules often fail – data quality.

Imagine you’re a new card company, and you’re trying to:

- Create in-house rules to mitigate fraud

- Develop robust risk models

- Pass data to your card issuing platform for decisioning in under 50 milliseconds

Imagine trying to create robust anti-fraud rules and making an intelligent authorization decision with incoming data that looks like this:

With Spade, Unit can enhance their data in real-time so that their card-issuing customers can create rules and make decisions based on data that looks more like this:

Better Merchant Intelligence = Smarter Decisions by Issuers

With better merchant intelligence, card issuers are not only able to provide more transparency to cardholders, they are also able to maximize interchange revenue.

A former colleague, an early Venmo employee, said they would joke, “The way to get fraud down to zero? Shut down the company.” As fraudsters become more sophisticated, issuers need to find smarter ways to decline illegitimate transactions without jeopardizing legitimate revenue for merchants and creating more unnecessary friction for cardholders. The only way to make smarter rules and decision-making processes is to leverage richer, more detailed data.

Transparency for Cardholders Starts with Good Data

In addition to helping identify fraud directly, better transaction data helps end customers understand where they spent money. This decreases the likelihood of cardholders being surprised and ultimately reduces the volume of chargebacks.

Emphasizing the value of transparency has been in vogue for fintech companies for the last 10 years. However, the level of transparency and consumer controls companies can provide to their end users is severely limited by the raw transaction data passed along from one player to the next. Let’s say Lindsay is visiting New Orleans for the first time and has the ability to lock her card if she sees suspicious activity. Little does she know that the oyster po boy shop where she just ate lunch has the wrong MCC code and appears on her app as a drug store. She freezes her card and no longer has access to that card for the rest of her trip. The extra cardholder controls provided to Lindsay are not super helpful if she’s being told she bought drugs when she just had a sandwich.

Why We’re Excited About Spade

Card issuing platforms such as Unit have fairly standardized offerings:

- White-labeled virtual and physical cards

- Card production services

- Deposit accounts

- Money movement

- Compliance services

However, by offering human-readable transaction data that customers can make authorization decisions against in real time, Unit may have just found a leg up against competitors such as Galileo or Synctera.

I wouldn’t be surprised if Spade becomes a ubiquitous data-enrichment provider across the payments value chain, helping smaller card startups and large networks such as Visa or Mastercard. I suspect they’ll positively impact the outdated fraud models leveraged by traditional financial institutions. VC investors such as Flourish Ventures, Gradient Ventures, Dash Fund, and a16z seem to agree.

The Era of Fraud Detection Innovation?

According to Spade, card issuers spend over $60 billion trying to combat issues stemming from messy transaction data, such as card fraud, disputes, and chargebacks.

I hypothesize that with the emergence of AI, combined with pre-existing big data tools, we may be entering an era of innovation within the payments fraud sector. Innovation in fraud detection feels like a natural progression of the overall fintech innovation narrative.

- 2005-2010: Rise in P2P lending and payments platforms (e.g., Venmo, Lending Club)

- 2010-2015: Innovation in merchant payments to enhance e-commerce and mobile payments (e.g., Square, Stripe)

- 2015-2020: Banking as a Service “BaaS” becomes prevalent (e.g., Treasury Prime, Sila)

- 2020-2025: Wide consumer adoption of Buy Now Pay Later tools (e.g. Affirm, Klarna)

- 2025-2030: Era of fraud data innovation?

Is Spade the first of many entrants into the fraud data innovation space? I’ll keep a close eye on their progress and look forward to seeing more innovation in this neglected but critical area of payments.

This Post is Sponsored by Spade

Spade provides real-time merchant intelligence for the card ecosystem. Spade leverages its ground truth database to link any card transaction to a real merchant identity – providing granular merchant, category, and geolocation information. Spade leads the market in terms of merchant coverage, geolocation matching accuracy, and speed of transaction enrichment, powering an authorization flow with a p99 of under 50ms. Customers such as Mercury, Sardine, Coast, and Unit trust Spade's data to authorize more transactions, prevent fraud, and build more innovative features.

CardsFTW

CardsFTW is a weekly newsletter, released most Wednesdays, that offers insights and analysis on new products in the credit and debit card industry for consumers and providers. CardsFTW is authored and published by Matthew Goldman and the team at Totavi. Totavi is a boutique consulting firm specializing in fintech. We bring real operational experience that varies from the earliest days of a startup to high-growth phases and public company leadership. Visit www.totavi.com to learn more.